To say the announcement of National CineMedia’s acquisition of arch-rival Screenvision stunned the cinema industry would be an understatement, even though the deal had been anticipated for some time.

Within the cozy confines of the cinema advertising industry this outranks deals like Dolby buying Doremi or even Omnicom and Publicis merging. Think Apple buying Samsung or Facebook acquiring Twitter and you get an inkling of the impact currently reverberating across every cinema screen in North America.

So how did this happen, what are the deal’s implications and will it actually go through? Most importantly, is the de-facto monopoly that this creates any good for the business?

The NCM-Screenvision Deal

The basic details of the deal are straightforward enough.

National CineMedia, Inc. (NCM Inc) has agreed to buy Screenvision for a total of USD $375 million, a combination of USD $225 million in cash and USD $150 million in stock. It is worth highlighting that NCM Inc. owns 45.8% of National CineMedia, LLC (NCM LLC), so it is not America’s largest cinema advertiser buying the industry’s second largest, but the largest shareholder in the largest cinema advertiser doing the buying.

The press release makes all of this quite clear:

Following the merger, NCM, Inc. will evaluate whether to contribute the Screenvision assets to NCM LLC. Although it is under no obligation to do so, NCM, Inc. expects that it will contribute the Screenvision assets and debt incurred to finance the acquisition to NCM LLC in exchange for approximately 9.9 million NCM LLC membership units and that the combined operation will result in an estimated $30 million of annual operating cost synergies. The merger will create a higher quality and more competitive video advertising network that will cover nearly all 210 Designated Market Areas across all 50 states and deliver to approximately 3,900 theatres with over 34,000 screens, reaching over 1.1 billion annual patrons.

A “kill fee” is attached to the deal. Should NCM decide to pull out or if the deal is rejected by the FTC it will be liable to pay USD $28 million, while Screenvision in turn will have to pay between USD $10 million to $18 million if it has a change of heart. However, given the fact that the acquisition has already been unanimously approved by the boards of directors of both NCM Inc. and Screenvision, as well as Screenvison’s equity owners, that is unlikely to happen.

So the only thing that stands in the way of the acquisition is the approval of U.S. federal regulatory authorities, which could take up to six months. (More on this in a moment).

With NCM LLC having traditionally dominated in larger markets as Screenvision focused on smaller markets, this means that a merged NCM-Screenvision will dominate in EVERY market throughout the territory. Who does this leave as the remaining cinema advertising players? Effectively nobody. North of the border there is of course Cineplex Media, which represents 93% of Canadian box office, but in the US there isn’t even a significant No. 3. BeforetheMovie, Inc. or Spotlight Cinema Networks anyone? No, cinema advertising has been a two-horse race since the formation of NCM and everybody else was pygmies. Now they are smurfs by comparison – sorry, 1 Better LLC.

A Deal Long Anticipated

The NCM-Screenvision merger is a shock but not a surprise. As far back as five years ago we wrote about it here at Celluloid Junkie, following the industry rumours surfacing in a USA Today article.

Back in May of 2010 we wrote:

A merger between Screenvision and NCM seems unimaginable, if not impossible, given the two firms majority share of the North American cinema advertising business. Surely there will be some regulatory group that will object to having only one company control most of the profitable advertising placement in the country’s leading movie theatres.

What ultimately made the current deal inevitable was Screenvision’s change of ownership in 2010 from ITV to Shamrock Capital Advisors, the investment vehicle set up by the late Roy Disney, for USD $160 million. On the same day it was announced that the ex-head of DCIP Travis Reid was coming onboard to head up the company. Shamrock held 61.2 percent of Screenvision’s stock, while Technicolor had an 18.8 percent stake and Carmike Cinemas 20 percent of the company, with which it had then close a 30-year exclusive deal.

It was clear that the company was to be streamlined and positioned for the near future when all cinemas would be digital, at which point Shamrock would sell. Just like the private equity firm that owned AMC before it was sold to Wanda, all such entities look for an exit at some point through a liquidation event (sale, IPO, merger, etc.). Shamrock has less of an interest in whether such a deal is good for the market, and more as to whether its good for their balance sheets (ROI) and investors (i.e. getting the highest possible price for the company). That is their fiduciary responsibility.

The key was thus for Shamrock to not steamroll the other stakeholders but to get unanimous support. So the price had to be right. Having sold on Screenvision to the only other obvious buyer for nearly twice what they initially paid for it, Shamrock has thus done very well out of the four year ownership of Screenvision and the minority shareholders are likely very happy too.

Timing Is Everything

[vimeo]http://vimeo.com/93178552[/vimeo]The timing of the deal is nothing if not opportune, coming after NCM’s quarterly figures and ahead of NCM’s upfront sales pitch in New York to potential advertising clients on 14 May (Screenvision already held theirs in NYC on 2 April – see above).

Expect NCM’s Kurt Hall to repeat the press release’s mantra that the incorporation of Screenvision’s network “will position the combined new company to be much more competitive in the expanding video and overall advertising marketplace, including the new online and mobile advertising platforms.” It’s not just about screens to give clients bang for their buck but engagement across platforms on second, third and even fourth screens.

As the company itself puts it, “NCM Digital offers 360-degree integrated marketing opportunities in combination with cinema, encompassing 39 entertainment-related websites, online widgets and mobile applications.” This includes the likes of the NCM’s Movie Night Out app and opportunities in the foyer and even beyond the cinema.

This time last year NCM announced its partnership with Twitter and Foursquare. Screenvision meanwhile had its own partnership with Shazam. Long-format adverts were tested with Microsoft and there was constant briefing that in the age of television ‘cord-cutting’ cinema was the medium for adverts to be seen and recalled. NCM has had some success in attracting new premium blue chip clients such as Apple and Samsung, with the Turbo programming enabling it to offer just 72-hours turnaround time for delivery of ads. Cliff Marks was recently quoted as saying:

“We are now not only America’s number-one network on weekends, but we are also the only cinema network with a media digital delivery system that can turn a brand’s spot around just like the other national networks in the TV world. I think that this once again shows our clients that NCM is always striving to make it easier for them to integrate cinema seamlessly into any video media buy and reach our key cinema audiences.”

However, because of the short time between the announcement of the acquisition of the upfronts, NCM has said that it will withdraw the upfront financial guidance for the current year, so that the impact of the merged NCM-Screenvision operation and market can be better assessed.

From a technical perspective, the acquistion will involve reconciling two different systems. Realistically, this will be a question of Screenvision’s system being phased out and what makes this all easier is that DCI specifications have standardized the projector and server end. On the distribution side, 80% of Screenvision adverts are delivered via satellite, so it will be comparatively straightforward to re-align them to NCM’s NOC or teleport.

Not Feeling The Love

NCM is in many ways an under-valued stock and company, which has crucially never recovered the initial high of its IPO price. This is not just a point of bother for institutional investors but above all for the exhibitor holding a critical stake in the company.

Here are some key bullet points about the company circulated prior to the announcement of the acquisition.

- The recent drop in shares of National CineMedia is a great buying opportunity for income and long-term investors.

- Shares still have yet to return to the highs seen after its IPO in 2007.

- Look for the company to increase not only its mix of national advertisers, but also local advertisers, which is its fastest-growing segment.

- The company’s expansion into online and mobile is helping the company bundle its services and provide added value to advertisers.

- National CineMedia benefits from its affiliation with the largest theatre operators – AMC Entertainment, Cinemark and Regal.

What has perhaps been talked about the least is NCM’s international potential. Following Wanda’s acquisition of AMC, one of the exhibitors with a major stake in NMC Inc., a direct connection opened for a business relationship with the world’s second largest cinema market, and one with an under-developed cinema advertising business.In July 2013 NCM Media Networks and Beijing China Times Media Advertising Co entered into an advertising cooperation and fee agreement ‘to help international brands reach movie audiences in the United States and China.’ This entailed opening up both markets for each other:

For American advertisers and their agencies looking to reach consumers in the second-largest movie market in the world, NCM can now offer access to cinema advertising inventory through the China Times Cinema Network, which includes over 200 Wanda Cinemas and other leading movie theater circuit affiliates across China. The Wanda Cinema Line is the top-ranked cinema circuit in Asia, with 116 five-star cineplexes and 985 movie screens, of which 69 are IMAX screens. In addition to exclusive resources of Wanda Cinema Line, the China Times Cinema Network also includes 96 other influential theaters and more than 600 screens nationwide, with an annual audience of over 60 million moviegoers. China Times’ cinema advertising network growth rate leads the industry with a 25 percent increase in the number of theaters and a 40 percent increase in audience impressions year-to-year. In June 2013, China Times obtained the IMAX screen advertising rights, making it the one and only agency with this exclusive right in China. Based on these industry-leading resources, the China Times Cinema Network could provide a competitive and attractive advertising option for global clients.

But while the writer for Seekingalpha was very bullish about NCM on the back of digital, Fathom, China and more, he did also inject a note of caution:

The big negatives surrounding National Cinema Media are its higher price to earnings multiple and a high debt load. The company’s shares trade at over 20 times current and future projected earnings. Revenue is only expected to climb 3% each of the next two years. This means investors would be placing bets on the high yield and future prospects down the road.

The company carries over $880 million in debt, which is sizable given a market capitalization of just over $1 billion. In the second quarter, National Cinema Media did re-finance much of their long term debt. Over 70% of debt is fixed and the average interest rate now stands at 5.5%.

In this way the acquisition of Screenvision is a “big bang” for the market to take NCM more seriously. And what about Screenvision? This is what Travis Reid says in the press release:

“I could not be more proud of the Screenvision team’s accomplishments in helping to drive the cinema advertising industry to where it is today. The choices for advertisers continue to grow daily, and I am excited by the possibilities this business combination creates to enable advertisers to use this high-impact medium even more effectively to reach their business goals.”

Read between the lines and it tells you that Travis and his team have achieved the goal of getting Screenvision to the point where it can be merged with NCM and make the soon-to-be former owners very rich, but that doesn’t mean that he has to be thrilled about it, not least with the majority of the management redundancies likely to come from the ranks of Screenvision.

Regulatory Approval A Foregone Conclusion?

The fact that the acquisition of Screenvision by NCM will create a monopoly is not in and of itself a reason for the Federal Trade Commision (FTC) to block the deal. The creation or existence of sole market entities is tolerated by consumers, market and regulators in numerous industries. (Just look a the merger of satellite radio companies Sirius and XM Radio into the only company offering such a service). It is the abuse of a dominant or monopoly position that invites scrutiny and anti-trust suits, as Microsoft discovered when it (ab)used its dominant position in the desktop OS field to bundle its Explorer web-browser at the expense of rivals.

So the NCM-Screenvision entity will be judged by whether it is likely to engage in monopolistic practices. This is of course speculation that cannot be substantiated unless there is evidence that the two separate companies were already exhibiting monopolistic practices in their pre-unification entities. What NCM has going in its favour is that there will be hardly any major exhibitors speaking up against the deal: AMC, Regal and Cinemark are all co-owners of NCM, while Carmike voted in line with Shamrock & Co. to sell Screenvision.

This just leaves Screenvision’s smaller exhibition clients: Allen Theatres, Bowtie Cinemas, Cinemagic, Classic Cinemas, Harkins Theatres, Krikorian Premiere Theatres, Malco, Mann Theatres, Muvico, National Amusements, UltraStar Cinemas and many others. Expect them to be getting reassuring phone calls today that their terms will be locked in or contracts renewed early to ensure that they get to keep or improve their terms and not be dictated to be the only player in town.

It is also unlikely that the National Association of Theatre Owners (NATO) will raise objections, although it will need to be seen to be examining the proposed acquisition critically and not just rubber stamp it simply because its largest members are all in favour of it. Because this is a strictly US deal there will be no need to weather any complaints from Cineplex Media in Canada or submit this to the European Commission for approval.

But NCM will still have to argue its case. So how will they do it? Behold below Exhibit A:

Cinema advertising spend in the United States is a rounding error of what gets spent on television advertising, its most closely related medium. If NCM-Screenvision decides to double the price for a 30-second spot, Ford or Coke can simply go to any one of the thousands of network, cable or satellite channels. That is, if they are not already spending it online instead. Cinema accounts for less than one percent of total ad spend in the United States. The fact that it is still included in the overall count is more of a tribute to the glitzy power of Hollywood than its inherent economic strength.

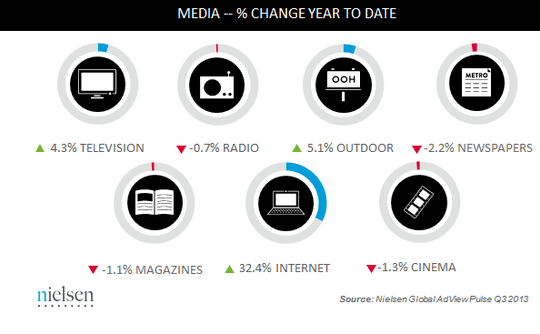

Don’t beleive us? Take a look at the following piece of statistic:

Look, NCM might say, cinema advertising is not just small but it went down in the third quarter of last year. So it is not only small but shrinking by some measurements. Expect also a lot of MPAA and NATO statistics to be trotted out showing that cinema audience numbers are declining, there is a backlash against 3D, that teenagers are turning their backs on cinemas and that the industry is in general malaise.

In circumstances like this the only rational way to stem losses is for the industry to consolidate, which is what NCM and Screenvision are doing.

The major unanswered question is if Ford can turn to E! or MTV to book their adverts if NCM is asking for too much, who will cinemas turn to. Even in a market like the UK, the industry can’t seem to accept the prospect of DCM swallowing its much smaller rival Pearl & Dean, despite the fact that following the loss of Vue Cinemas, its is clinging on to a 25% market share in a significantly smaller market than the US.

However, with the likely federal regulatory approval of Comcast’s acquisition of Time-Warner Cable it is unlikely that a much smaller deal like NCM-Screenvision will be held up. It is worth remembering that the last major merger to be blocked in the US was AT&T’s proposed take-over of the smaller T-Mobile USA cellphone network. This would “only” have reduced the number of operators from four to three, but was seen as so critical to consumers that it did not pass the muster of public interest. Cinemas are nowhere near as important as cell phones, regretfully.

Wither CAC?

One of the most important issues this raises is where this leaves the Cinema Advertising Council (CAC). While in theory an industry body for the promotion of cinema advertising, the CAC has often felt like a boxing ring with NCM and Screenvision repeatedly slugging it out round after round. Industry insiders speaking to Celluloid Junkie on condition of anonymity said that CAC often felt semi-paralysed because of this infighting between NCM and Screenvision on several key issues.

Now that the only two members of CAC that matter are about to become one, is there any role left for CAC? Surprisingly, the answer is ‘more so than ever’.

First of all NCM-Screenvision need CAC as a figleaf to obscure the fact that they/it ARE the cinema advertising industry and every other member is effectively an onlooker or equipment vendor. There needs to be an appearance that there is more to the cinema advertising industry than NCM-Screenvision and CAC is it, even if the other members account for less than 10% of the business. As such we will expect Cineplex Media to be given a more prominent position within the group, perhaps elevating it to de-facto spokesperson for the Council, while NCM-Screenvision runs it behind the scenes.

Secondly, CAC will still be needed as a proxy in dealings with other sectors of the industry and trade bodies. It will still have to not just appease regulators, but other cinemas, as well as international trade bodies such as NATO, the Screen Advertising World Association (SAWA) and the Event Cinema Association (ECA), to mention just the most obvious. In all of these NCN-Screenvision will not want to deal with them directly, even as they pull the strings.

So expect CAC to continue and even to operate more efficiently, even if there is just one company calling the shots.

Fathom and Screenvision

A more interesting problem arises from the alternative content (a.k.a. ‘event cinema’) operations of Fathom Media and Screenvision. As you will remember, NCM Inc. has spun off Fathom Events into its own company last year and last month appointed John Rubey as its head. As we wrote about the appointment at the time:

If we are to believe Hall, the split was always a part of the master plan for Fathom once the alternative content division could stand on its own. Looking at it from another perspective, three of the world’s largest exhibition chains, AMC Entertainment, Cinemark and Regal Entertainment Group own a combined 54.3% of NCM and by spinning-off Fathom, they now own two different companies and have an additional revenue opportunity. AMC, Cinemark and Regal each have a 32% stake in the new Fathom with NCM holding onto the remaining 4%. That means the theatre operators could potentially see a bigger share of Fathom’s profits. Granted, the theatres couldn’t simply force NCM, a public company, to jettison a potential profit center after the advertising company helped launch the business. To make up for their troubles NCM will receive six year notes at 5% from each of the cinema chains amounting to a total of USD $25 million.

This payment obviously helps NCM Inc fund the acquisition of Screenvision, but it also creates a potential messy situation in that Screenvision has its own alternative content division. Where does this leave Screenvision’s recent deal with Digiplex? Screenvision screens Royal Opera House performances while Fathom Events shows the Metropolitan Opera. The likelihood of a merged entity showing operas from both houses is about as likely as the ROH and Met themselves merging.

The gameplan is on the one hand clear. After it has been approved and chopped up, Screenvision alternative content arm will be sown onto the Fathom body in the hope of making it a larger and even more dominant player in the event cinema field. Eventually the owners will want an IPO for Fathom Events just like they did for NCM.

However, Fathom is too small and financially unstable to be able to pay a significant amount for Screenvision’s alternative content operation. As we have seen, it is also questionable how much of it is viable as part of Fathom Events, given the non-compete nature of inherent with simulcasting seasons of ROH and Met Opera Live. On the other hand, NCM Inc. cannot ‘gift’ away what is seen as a growing business nor is unlikely to want to sell it off to anybody else that might end up competing with Fathom Events. This part of the NCM-Screenvision deal really is the hardest to fathom the financial upside to or outcome of.

Conclusion

The absorption of Screenvision into NCM LLC thus makes financial sense for NCM Inc, plus the previous owners have been handsomely enough rewarded to give the deal their backing. But does it makes sense for cinema and cinema goers?

There is no question that cinemas depend on advertising. Perhaps more so than ever at a time when audience attendance seems to be plateauing or even declining in North America and western Europe, while at the same time Hollywood seems mostly concerned with its fortunes in China, Russia, India, Turkey and other emerging economies. Costly investments in cinema dining and more luxurious seating, with fewer bigger seats making the cinema seem less empty, will furthermore not pay for itself quickly. Even concessions are under attack.

Digital technology has for a long time been recognised as the saviour of the cinema advertising medium, allowing it to punch far above its weight with innovation and inspired campaigns that reach far beyond the screen itself. While cinema advertising may not always be popular with cinema goers (at least not in the U.S.) it is much better than it ever was in the age of stale slides or scratched and poorly spliced 35mm prints. It could thus be argued that cinema advertising does not need to be ‘saved’ by any corporate deals.

NCM LLC and Screenvision were doing a good job of supporting the cinema industry as separate companies. We have yet to hear a convincing argument that merging the two operations will lead to more money for cinemas, better terms for advertising clients or higher quality campaigns for consumers. Nor is there any indication of how this will improve the alternative content/event cinema market.

Anyone hearing this news with any knowledge of the industry would question the consolidation of pre-show advertising agencies from two to one. Maybe the market (and the portion of the total advertising spend / market) isn’t big enough for anyone to care, but people in the industry should be demanding that NCM Inc. makes a stronger case as to why this deal should be allowed to go through.

As it has currently been proposed, it doesn’t appear to pass the public or industry interest test.