Yesterday, Wanda-controlled AMC Theatres was revealed as the buyer of the European Odeon & UCI cinema chain (encompassing 242 locations that house 2,236 screens) in a deal valued at GBP £921 million (USD $1.199 billion). These terms mean AMC is getting a good deal, in what the company’s CEO and President, Adam Aron, admitted was an “opportunistic transaction,” representing “a once-in-a-generation opportunity to acquire Europe’s leading cinema chain and create the world’s biggest and best theatre operator.” But the acquisition is also good for Odeon & UCI, though less so for the seller, Guy Hands’ Terra Firma.

This long-read will examine the details of the deal, what the implication of the new global mega-circuit is, how it affects AMC’s proposed acquisition of Carmike, what Wanda’s role behind the scenes was, what isn’t being explicitly said about the deal (such as the buyer needing deep pockets) and more. As always, we are indebted to the many senior industry insiders we have spoken to, whom we cannot thank in person (at their own request), but who help us understand such business transactions and make our analysis what it is.

Why did AMC emerge as the winning bidder of Odeon & UCI?

Rumour has it that the final competition for Odeon came down to AMC and Vue, a scenario in which AMC had more to gain. If Vue had acquired Odeon it would have meant spinning off as many as 50 sites in the United Kingdom alone, as well as deciding which of two flagship sites to keep in London’s Leicester Square.

Vue would have made a rod for its own back by strengthening rivals like Cineworld and Everyman that could have picked up some choice locations at a knock down price (being forced to sell sites doesn’t make for a strong negotiation position), or creating a new rival like Empire Cinemas, only three times as large as Empire, which was born out of the Odeon-UCI merger, when the merged entity was forced to spin off 11 Odeon and six UCI sites by the now defunct Office of Fair Trading.

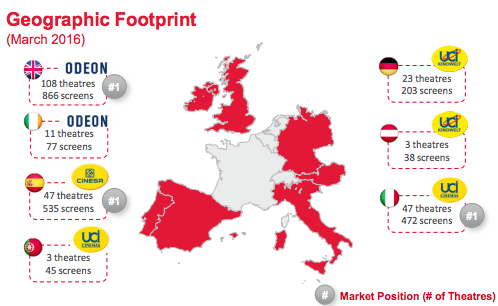

Vue would also have had to sell off sites in Germany and Italy, where both Vue and UCI have a significant footprint. The cost-benefit analysis simply didn’t add up. AMC has just one site in the UK and while it has to get antitrust clearance from the European Commission, in addition to consulting with the European Works Council, Adam Aron clearly stated that, “There is simply no antitrust risk here,” meaning it will not have to sell off any sites. But don’t feel too sorry for Vue, who has had a good rummage through Odeon’s corporate underwear drawer and will use this knowledge to its advantage in the coming years.

Other contenders couldn’t, or wouldn’t, match AMC’s spending power. South Korea’s CJ CGV had to get a co-financier onboard to buy Turkey’s Mars for USD $800 million. Mexico’s Cinépolis would happily have cherry picked Odeon’s Cinesa screens in Spain and Portugal to consolidate its European foothold achieved through buying Spain’s Yelmo, but this was clearly not an option for Odeon & UCI. Cinépolis and CGV can instead focus on expanding in emerging markets like India and the rest of Latin America (Cinépolis) or Vietnam and Indonesia (CGV).

There is also nothing to prevent either Vue, CGV, Cinépolis or another of the mini-majors from making a surprise bid for Regal, or even launch a spoiler bid for Carmike, in the United States. However, rumours that Vue will come with a higher bid for Odeon & UCI are at best wishful thinking by Guy Hands, whose private equity firm Terra Firma owns the circuit. Vue had the option to buy Odeon & UCI and it didn’t.

Why didn’t Wanda buy Oden & UCI directly?

Wanda had previously denied that it was looking to buy Odeon and technically this is true, since it is Wanda’s American subsidiary that is making the purchase. AMC CEO Adam Aron should also not be seen as Wang Jianlin’s hand puppet. But it is clear that Aron was brought in to replace former AMC CEO Gerry Lopez with a clear mandate to grow aggressively through acquisition. Carmike CEO David Passman revealed that Aron called him in the first week into his new job. In fact, Aron had been recruited from the hospitality business on the strength of his M&A skills, having engineered the USD $12.2 billion to sell Starwood Hotels, for which he was interim CEO, to Marriott. Together they will create the world’s largest hotel company. Who better to create the world’s largest cinema chain?

Wanda has only directly acquired the US-based AMC and seems happy to conduct all of its international cinema empire building through AMC. But what about Australia’s Hoyts you might ask? Yes, however Hoyts was not acquired by Wanda on the open market, but rather in a back-room deal with the previous Chinese owner, the investment firm ID Leisure Ventures owned by Sun Xishuang. Wanda may yet re-organise its ownership, grouping Hoyts under AMC. Though for all practical intents and purposes Hoyts will already benefit from being part of Wanda’s AMC family of exhibitors.

Given the recent financial manoeuvring of Wanda to combine its cinema and studio efforts – including absorbing its USD $3.5 billion acquisition of Legendary Entertainment and the USD $3.3 billion investment in EuropaCity inParis – the last thing Wanda needed was issues with Chinese regulators over buying a European cinema chain, for just one third of what it was spending on these two other big ventures. It is also worth remembering that the Chinese stock market is down, causing a drag on Wanda’s share price, because while revenues climbed by 11% for Wanda in the first half of 2016, the Chinese box office saw growth of just 2% in the same period, signaling a possible future slow-down for Wanda too.

But there is another important reason for AMC to buy Odeon & UCI, revealed in the above chart. The British pound has crashed in the wake of the Brexit vote (more on this later), but the third-worst performing currency this year is the Chinese Renminbi, which has lost nearly 10% of its value to-date. Meanwhile the US dollar (the base against which these currencies are measured) is strong, while the Japanese have the biggest year-to-date advantage at 20% and even the Canadian loon is doing well, up 5% (but not up enough for Vue’s parent fund to make a bid for Odeon).

Buying in dollars just makes sense. Or as the Finacial Times put it, “Coming soon to a theatre near you: Brexit – the bargain hunters awaken,” calling it ‘the biggest UK post-Brexit deal.’ CEO Adam Aron was no less explicit about this in a call with analysts. “The Pound is just dirt cheap. We believe we should strike while the iron is hot….We got a bargain price.” (Nigel Farrage and Boris Johnson ought to be on Aron’s Christmas card list after this.)

Still, Wanda is firmly in control and the way the deal is structured leaves it very much in control through AMC, not least given the company’s dual class stocks, with Wanda owning 78% of the shares in AMC, but a much higher 91% of the voting power. As one industry financial expert reviewing both Wanda and AMC told us upon news of the Odeon acquisition being made public:

Wanda’s greater voting power comes from a dual class structure. From what I can gather, the Class B shares that Wanda holds get 3 votes per share compared to only 1 vote per share for the Class A common stock, so Wanda can retain control even if its shareholding falls below 50%. However, there appears to be a clause whereby the Class B shares convert to Class A (and Wanda loses voting control) if the total shareholdings of Wanda (Class A and B) drop below 30% of all shares, so they do need to avoid too much dilution. That said, they have a long way to go before that happens.

With the Odeon & UCI deal structured 75% cash and 25% shares (as well as the assumption of debt) this means that Wanda hardly dilutes its equity. So it is all the upsides and none of the downsides of buying Odeon & UCI through AMC.

There are also additional reasons for AMC being the parent company, such as closer corporate cultural ties between Leawood, Kansas, where AMC is headquartered, and London and Manchester, UK, which are Odeon’s twin-bases, than with Qingdao, China. (Good news for Odeon & UCI’s CEO Paul Donovan, who won’t have to learn Mandarin.) Kansas is also much closer to Los Angeles, when it comes to negotiating film rental terms with Hollywood studios, Atlanta, when it comes to doing business with Coca-Cola and really close to Wood Dale, Illinois, home to popcorn major Cretors. There is also less of a perception that “The Chinese are coming'”, as one senior European exhibitor personality jokingly put it in a Facebook post upon hearing news of the acquisition.

Did AMC get a good price for Odeon & UCI?

Yes, yes and emphatically yes. If Adam Aron’s negotiating team didn’t do a victory dance in the room where the deal was signed, it was probably because Guy Hands’ team looked dejected enough already for not having achieved the hoped-for GBP £1 billion price (or even the £1.2 billion they wanted in 2011!), without also having champagne rubbed into their wounds.

It was rumoured that the deal would be announced prior to CineEurope, but in the wake of the UK vote to leave the European Union on the last day of the show and the pound subsequently crashing, this means that AMC stands to reap a handy Brexit discount. According to the WSJ the vote was factored into the discussions.

Mr. Aron said AMC and Terra Firma started the latest round of tie-up talks in March. There was an agreement in place in June, but talks paused as the Brexit vote neared and both sides awaited the outcome, he said.

The GBP £921 million price tag meant that on 23 June (the peak of pre-referendum optimism) the Pound closed at 1.5005 to the Dollar, valuing the deal at USD $1.38 billion dollars. It since fell as low as 1.2892 on 11 July, meaning the deal was worth USD $1.18 billion or $100 million less. The Pound has since recovered a bit to 1.3285 in the wake of Britain’s speedy transition of prime ministers, but some believe the Sterling could come close to parity with the dollar.

AMC’s take on the deal is “Assuming a Dec 31, 2016 close, transaction valued at $1,199 million” based on GBP/USD spot rate of 1.30 as of July 5, 2016. This is only slightly higher than the 31-year low of the Pound, which means that depending on the terms of the deal and when it closes, it would not take much for it to potentially drop by another USD $100 million. Meaning, the purchase could soon fall in the same price bracket as AMC’s proposed acquisition of Carmike (more on this further on). Given that 75% of the deal is cash, the exchange rate is an important factor.

But exchange rates are far from the only reason this is a good deal for AMC. Let us break down the terms of the deal, not least the critical fact that more money will need to be spent than the sale price to make Odeon & UCI healthy for the future. Here we are again indebted to our un-named financial number cruncher, who shared the following insights:

That they are doing a stock and equity deal shows the value of AMC having done its IPO back in 2013, giving it a “currency” that it can use in making acquisitions, especially of private equity owned companies like Odeon & UCI. AMC doesn’t need to raise cash for that part of the deal, but the seller, Terra Firma, gets the liquidity they are looking for (albeit subject to a lock up period, not disclosed how long).

Wanda was smart to buy AMC and then swiftly put it back on the stock market, given how high its share price has been climbing since then. With it’s solid credit rating, AMC can also borrow money cheaply both for refurbishing its own cinemas, as well as for acquisitions such as Carmike (we promise, we’ll got to that) and Odeon.

It is also important to remember that GBP £921 million (USD $1.199 billion) is not the price being paid but the valuation of the deal. The equity was GBP £500 million (£375 million in cash and £125 million in shares), with AMC assuming GBP £407 million in debt. This debt will be refinanced when the deal closes, with AMC most likely paying less interest than Terra Firma. Citi, the bank that advised AMC on the acquisition, will be arranging the debt facility. AMC will then have to pour in several more hundreds of millions of dollars to allow Odeon & UCI to make vital upgrades that are long overdue.

Yet what matters perhaps the most is not the exchange rate or the sums of money, but the valuation of the company based on earnings and EBITDA. This is where it becomes apparent that AMC negotiated a good deal. Again, from our financial wizard:

- Odeon UCI reported EBITDA of £94.8m in 2015, so a £921m valuation enterprise value (EV) implies an EV/EBITDA ratio of 9.7

- This seems to imply at most a modest discount (10% or less) compared to other large cinema chain valuations

- AMC itself has an 8.9 EV/EBITDA though the stock also jumped on the news of the Odeon acquisition so its own valuation was probably only 8.5x EBITDA before the deal

- Regal and Cinemark trade for 9.0x and 8.4x EBITDA respectively and the Carmike deal is valued at 8.2x 2015 EBITDA

- Those are all US circuits, a better comparison would be of a European one. Cineworld apparently has a 11x EV/EBITDA which would imply no real acquisition premium

- It is also possible that AMC sees EBITDA at Odeon-UCI being much stronger in 2016, and so isn’t paying such a premium over forward expectations (what one is supposed to look at in such dealings)

- Odeon & UCI EBITDA had grown 85% from 2014 to 2015, on just under 20% revenue growth, showing a positive trend

- Q1 EBITDA was up 22% over the same quarter in 2015, so showing strong year over year growth

- The AMC press release indicates that the company intends to keep debt financing in Odeon & UCI at about 4x EBITDA over the long term, so if EBITDA is growing a bit from £94m to likely exceed £100m then they intend to keep debt just above £400m, or more or less right where it is now, so there doesn’t seem to be a big intention to take cash back out by piling on more leverage.

- £125m in shares, assuming 1.3 exchange rate means around $162m in new equity being issued by AMC, which is 5.85m shares at the closing price before the deal was announced. Wanda is thus likely to still own more than 73% of the total shares and 89% of the voting power after the close of this deal.

- The Carmike acquisition is an all cash offer and so isn’t going to dilute Wanda

Below is the graphic that summarises why the Odeon deal is more competitively valued then the value the stock market places on some of Odeon’s publicly traded rivals.

It is noteworthy that many of these billion dollar acquisitions are more leveraged, meaning that they combine equity and a lot of new debt. In this case AMC is assuming existing debt, but not piling on new debt, and paying for the rest primarily in cash, whilst throwing in only a little equity. Similarly for Carmike it was an all-cash deal. Terra Firma may have had a higher bid from another suitor, but that could have involved less cash and more equity and/or debt, with more onerous lock up periods.

Terra Firma badly needed this deal, not least as last month the firm abandoned its expensive lawsuit against Citigroup (nice irony: Citi advised AMC on the Odeon deal) over the disastrous take-over bid of EMI in 2007, which Citi had also financed. Guy Hands put a brave face on the deal, “We are delighted to realise our investment in Odeon & UCI after 12 years of ownership. In that time, over £600m was invested in growing the business and delivering our long-term transformational strategy.” True, but having put the same money in a tracker fund would have delivered a lot more returns and less anxiety. Lest we forget, Hands paid himself a €115 million special dividend when the Odeon and UCI businesses were merged.

But AMC also needed this deal, at least it needed the deal to happen before 15 July. Why? Because of its ongoing acquisition of Carmike.

What does the Odeon deal mean for AMC’s acquisition of Carmike?

AMC’s deal for Odeon is an indirect shot across the bow against the hold-out Carmike shareholders who argue that the USD $1.1 billion valuation is too low, forcing a delay in the shareholder vote to approve the deal. They may come to regret delaying the vote, because the Odeon & UCI deal has given AMC plenty of ammunition.

We have covered the details of the AMC-Carmike dispute in detail previously and will also be updating you in the future. On the same day as announcing the Odeon & UCI acquisition, AMC also issued a separate statement affirming that it “remains committed to moving forward” with the Carmike deal, but darkly warning “the likelihood of an AMC/Carmike transaction continues to be at considerable risk.”

…as per our statement two weeks back, some Carmike shareholders have an unrealistic view as to Carmike’s value to AMC, and their resulting price expectations are simply beyond what AMC believes is prudent to pay. We have said all along that AMC is a disciplined buyer, and that very much continues to be the case.

We intend to continue to work this week with Carmike to see if the AMC/Carmike transaction can be saved, but we again note that the economics of a transaction get marginal very quickly for AMC above the $30 deal price.

In case you need this translated into blunt English, Mr. Aron is effectively saying, “We told you we had no more money to throw at you Carmike. We were serious. We have even less now that we’re buying Odeon. Oh, and check the EBITDA multiplier on the Odeon deal and you’ll see it’s similar to what we offered you.”

AMC has even gone so far as to point out that it doesn’t need Carmike to be the world’s largest circuit (not even counting Wanda and Hoyts), once the deal with Odeon & UCI is complete. “I don’t know that we are rushing out to find some replacement for Carmike because there is a void,” Aron said in an interview with Bloomberg. “I actually think the void for Carmike has been filled by Odeon UCI.” He re-stated to the WSJ. “Given that we have Odeon now, we don’t have to do both of these acquisitions.” But according to Bloomberg, Aron also let slip what poker players call a ‘tell’ in discussing his willingness to walk away from the Carmike deal:

It’s clear that AMC still wants Carmike, though. Aron slipped in a key word: the probable need to issue equity to keep AMC’s leverage in its target range should the company be able to complete both transactions. AMC is paying for the Odeon deal partly with stock, which is something that some Carmike shareholders had hoped for. The deal they’re scheduled to vote for is currently all-cash.

We don’t know how Friday’s vote will go, but more than one Carmike shareholder is surely looking at the Odeon & UCI deal and realising that they are unlikely to get a significantly better offer and definitely not the USD $40 as some had been hoping. Unless Vue or Cinépolis walked away from the Odeon deal with cash burning a hole in their pocket, which is unlikely.

A really great day for the Odeon & UCI family and a fitting outcome for the hard work and dedication of our thousands of colleagues.

— Ian Shepherd (@IanAShepherd) July 12, 2016

Why is this a good deal for Odeon & UCI?

To say that the people at Odeon & UCI are happy about the deal would be an under statement. Try ecstatic and/or relieved. So why is this a good deal for Odeon? The immediate good news is that the company will not be split up. The UK/Ireland Odeon operation won’t be separated from the European UCI operation. Individual sites or country operations like Cinesa will not be spun off. Pretty much everyone gets to keep their job. The group even gets to keep its brand name(s). Who wouldn’t be happy? In addition there is a GBP £14m employee incentive costs factored into the deal, most likely retention grants in the form of equity to management so they stay on board for the transition.

Obviously the group was happy to go from being Europe’s largest cinema operator to being part of the world’s largest cinema operation. There is also more cultural affinity between the UK and USA than with Korea or Mexico, even for the good international approach and local understanding that both CGV and Cinépolis have demonstrated. Being bought by AMC also somewhat takes the edge off Brexit uncertainties which now plague businesses operating in both the UK and on the Continent.

AMC appreciates that one of the strongest current assets of Odeon & UCI is its senior management team, led very ably by Paul Donovan, who took over from the less-than-stellar stewardship of Rupert Gavin, turning Odeon & UCI’s fortunes around.

Yes, the company has had to sell of the deeds to the real estate in which many of Odeon’s crumbling properties are located just to stay afloat. But at the same time it has streamlined the European UCI operation, shared best practices across sites, launched the Innovation Lab, tested variable pricing and other innovations, abolished credit card surcharges, improved its online booking, switched from Pepsi to Coca-Cola, doubled down on staff training and carried out countless other improvements that have started to show a clear difference in the company’s bottom line.

That said, there is still a reason Odeon & UCI is valued at a lower multiple than Cineworld and Kinepolis. While it may be the largest operator across Europe and number one player in UK, Spain and Italy, what matters more is not which countries it is in but which countries it isn’t in.

Unlike Vue and Cineworld, Odeon & UCI does not have a presence in Poland or other growth markets in Central and Eastern Europe. Sure, the chain is in four of the five largest European markets, but to claim that they have “growing theatre attendance” is stretching the truth when moviegoing has largely flatlined over many years in territories which Odeon & UCI operate.

The overall German cinema market is even set to shrink in the next ten years. The UK is still a big market, but the falling value of the pound translates into lower dollar revenue, even without the uncertainty of Brexit. Spain is recovering after having taken a serious downturn after the Great Recession of 2008. And Italy is, well, Italy. In many ways the most dynamic markets are also the smallest ones: Ireland, Portugal and Austria, but between them they only amount to 17 sites, which is less than any other of the four big markets.

Synergies? What $10 million synergies?

One of the reasons AMC touted for wanting to acquiring Oden & UCI is the unlocking of USD $10 million worth of synergies annually. But where exactly will these synergies come from? AMC has not gone into great detail about this (yet), though it did so for its proposed domestic acquisition.

Here is what AMC CEO Aron had to say about the anticipated annual USD $35 million synergies between AMC and Carmike in a conference call to analysts after news of the acquisition was made public:

I need to say this one very carefully. We will be laser-like in our pursuit of cost synergies, whether that be film exhibition expense, concessions, operating, G&A (general and administrative), overhead costs, you name it. We’ll be turning over every rock to get those synergies that are out there for the taking when we put two companies together into one. We similarly will be focused on retaining Carmike’s lower cost structure at theaters with lower visitation. We intend to be a lean operator.

Carmike has a corporate jet; Odeon doesn’t. Carmike’s headquarters will be moved to Kansas; Odeon’s will remain in London. Carmike CEO David Passman will have to step down; Odeon’s CEO Paul Donovan will remain in his position. This is why the Odeon synergies are put at less than one-third of what they were for Carmike. But they still have to be found somewhere.

The obvious strategy would be to flex the greater corporate muscle of being the world’s largest exhibitor, including the Wanda/Hoyts circuit, by demanding better terms from studios, vendors and concession suppliers. Yet Aron previously said in an interview with Deadline that he doesn’t see AMC’s expansion as “something that will work against studios in a zero-sum game…We can deliver more value to our Hollywood studio partners.” But with regards to these discussions AMC will play its cards close to the vest. From the same Deadline interview:

Once you start moving into discussions about film rents and purchasing synergies, we’re starting to tread on the sensitivities of our partners. Just be highly confident that we will deliver the synergies we told you we would and let us go about achieving them in a classy manner … Sunshine is not always the best disinfectant. Sometimes sunshine is pouring gasoline onto a fire.

In other words, we’ll be squeezing all our suppliers for better rates, but don’t want to brag about it publicly. And this is not to say that AMC won’t press studios for better terms, but the company will not do so without offering something in return. What that is at this stage is not exactly clear, but it could involve better data sharing and access to customer insights so that studios can better target their own marketing spending. If ever there was an opportunity to undertake such initiatives, now is the time, especially given both Odeon and AMC have ‘unlimited moviegoing’ schemes in place that, coupled with Big Data, could be a major boost.

Yet it needs to be pointed out that in regards to booking, there are fewer advantages to having circuits on two continents. This is unlike the Carmike deal in which all the US regulations surrounding film rental are the same currently adhered to by AMC. In the EU there are different booking regulations territory-by-territory. It’s not as clean an advantage or means of producing leverage and Odeon has already done the heavy lifting of streamlining seven individual country operations into one pan-European operation with local flavours.

Whisper it quietly but AMC could even learn some things from the Odeon & UCI’s operation, meaning that not all of the USD $10 million have to come from just the one side the Atlantic.

Can comfy seats by the saviour of Odeon?

So how is AMC planning to increase Odeon & UCI’s revenue given that attendance and screen count is unlikely to grow? By focusing on what has been a success in its home market: specifically re-seating auditoriums, outfitting theatres with recliner chairs as well as an expanded focus on food and beverage options. Aron was open about this in discussing the acquisition, “With this opportunistic transaction, AMC will be extending the reach of our proven guest experience strategies to transform the movie-going experience for millions of movie goers in Europe.”

AMC has already identified sites for a first phase facelift, according to Yahoo! News:

Aaron told investors Tuesday that the company has already identified 50 Odeon and UCI theaters “ripe for an AMC-style overhaul” that would include such improvements as better food offerings and reclining seats.

Given that Odeon & UCI has been “relatively capital-starved” (in Aron’s words) under Terra Firma’s ownership, they have had to focus on smart innovation, rather than expansions, new builds, acquisitions or capital-intensive refurbishments. According to the Associated Press:

Stifel analyst Benjamin Mogil said in a client note that AMC’s plans to invest in the chain were relatively detailed, including $250 million to $350 million in investments over five years to refurbish the theaters.

If Odeon & UCI pulls off significant growth under the new AMC ownership, it will partly be because the company already has a strong track record of growth. The combined Odeon & UCI EBITDA rose 85% in the period 2014 to 2015, on just under 20% revenue growth, pointing to a positive trend that went above and beyond just a strong year at the box office. Moreover, EBITDA for the first quarter this year was up 22% over the same quarter in 2015, so there continues to be strong year-on-year growth. All the more impressive as well that AMC did not have to put the valuation of Odeon & UCI at expected forward earnings, as is often the case in major mergers and acquisitions.

As is evident form the above chart, AMC expects to have upgraded close to 500 screens in the Odeon & UCI circuit over the next five years, while increasing its own plans from 1,208 to 3,410 in the same period (includes new builds, spot acquisitions, conversions and closures), for almost 4,000 screens in total. Dine-in theatre growth will be less than that, at just 22 for Odeon & UCI, but still an important component.

These are not the only ‘customer initiatives’ for which the European market is ‘ripe’ according to AMC. Annual spend per customer is USD $32 in the US but only USD $14 as an EU average and USD $28 in the UK. There is also scope to increase the number of Imax screens, though markets like Germany have proven resistant to that concept.

We should recall that while Odeon & UCI have been capital starved, they do not lack experience in both comfortable seating and dine-in theatres. We reviewed Odeon’s Whiteley Centre’s The Lounge more than two years ago and were not overwhelmed:

I can only conclude that if you are a real film buff or food connoisseur, then luxury film going is not worth it. If you want a more upscale experience try someplace like the Everyman or the Electric that offer comfy seats and decent snacks without the service issues.

Perhaps the service has improved since then, but then so has competition from the likes of Curzon, Picturehouse and Everyman. There are major differences between the US and UK cinemas markets, even more so when it comes to the many European cinema markets. Time will tell if AMC is being overly optimistic in its expectations of exporting re-seating and dining know-how to its latest subsidiary.

Conclusion and Outlook

In hindsight AMC’s acquisition of Odeon & UCI not only makes sense but seems like a win-win for all parties, while Wanda should be pleased with its empire building-by-proxy. Even without counting in the Wanda-Hoyts screens, and whether or not the Carmike vote this Friday goes in AMC’s favour, the acquisition will create the world’s biggest cinema chain.

It is also clear that our original prediction about five or six global super circuits will have to be adjusted. There is only going to be one mega circuit, which is Wanda/AMC. There will be a concerted effort by the likes of CGV, Cinépolis, Cinemark, Cineworld and Vue to hit the magic 10,000 screens mark, but given factors such as high valuations of Indian circuits and emerging markets already being ‘colonised’ (for lack of a better word), there is less and less room for manoeuvre. Yes, both Regal and Cineplex represent desirable acquisition targets, but structuring a deal that does not over-leverage a smaller buyer will not be easy.

This is not to say that more deals will not happen soon. According to the Wall Street Journal, the Odeon & UCI deal could be a portent of things to come. As Mr. Aron of AMC put it, “We’re certainly not going to be the last [major acquisition]. There may even be a stampede of U.S. acquirers looking at the United Kingdom.”

J. Sperling Reich contributed reporting to this post from Los Angeles.