IHS Technology recently published an Insight Report on “The market for Premium Large Format (PLF) cinema” as part of its Cinema Intelligence Service. Authored by Principal Analyst Charlotte Jones, the report does an excellent job of providing a comprehensive and data-focused overview of the PLF market.

With “Interstellar” shortly set to lift off in Imax, PLF and 70mm screens, it is thus worth shining a bright light on the biggest of all screens in the cinema business.

Premium large format (PLF) is a market that was practically invented by Imax but only took off when the large format (LF) operator switched from 40-50 minute documentaries in museums and institutions to showing first-run Hollywood films multiplexes.

Having survived the “Lie-MAX” backlash in 2009 of retrofitting Imax screens into too-small multiplex auditoriums, Imax has grown strongly on the back of the initial popularity of 3D films (think: “Avatar”) as well as major international expansion.

But Imax strict business terms and high licence fees, coupled with advances in digital cinema technology, has led many cinema chains to launch their own-brand PLF screens, often in competition or in parallel to Imax’s screens.

The PLF space has received a recent boost from the launch of the Dolby Atmos and Barco Auro 11.1 immersive audio (IA) formats that help distinguish PLF screens from non-premium screens, as well as the imminent launch of laser projection for high-brightness stereoscopic 3D on even the largest of screens. High frame rate (HFR) and 3D on the other hand are by themselves not sufficient enablers for PLF, as the report notes, even though they often command higher ticket prices.

It is the brand(ing) that has proven the key differentiator for Imax, with own-brand PLF screens struggling to match it in terms of cache and perceived value. (If you don’t believe us, we invite you to read on-line reviews of cinemas’ own-brand PLFs to see comments littered with ‘rip off’ and ‘pretend Imax’ vitriol). Yet though the report only hints at it, there are two operators/brand that post a significant threat to Imax at least in two key PLF cinema markets, which we will get to later.

With over 1,400 digital LF screens world-wide, the report identifies North America as the biggest battle ground for PLF, with both Canadian-originated Imax and own-brand PLFs having a significant installed base.

According to new research from IHS, there were a total of 1,401 digital PLF screens (Imax and exhibitor PLF) operating worldwide as at H1 2014, of which exhibitor PLF accounted for over half or 54.3% of the total, although this ratio does differ by region.

The growing market for exhibitor branded PLF screens is driven by several factors including a strong revenue upside, market competition factors, a need to raise the competitive bar with the home theatre environment and more generally striving to present the ultimate theatrical experience. This trend has now reached a new milestone with exhibitor PLF screens (374) outnumbering Imax digital (360) for the first time in North America.

While the two types of PLF are thus balanced in North America, the own-brand PLF significantly outweighs Imax screens in both Latin America and Africa/Middle East, with Imax only outweighing exhibitor’s own PLF screens in Europe.

The growth of local titles such as Russia’s “Stalingrad” released in Imax – which has more restrictive terms on which titles it plays, compared to own-brand PLF – has been a major factor on boosting the popularity of the format, though Hollywood films dominate.

With the number of international screens having overtaken the Imax screens in North America, this trend is likely to accelerate, with local releases likely to continue doubling as they have in the most recent year.

The chart illustrates how Asia has grown to be the second most important market after North America, but do not be deceived by Eastern Europe only accounting for 2%, because it represents an even bigger potential than more obvious markets such as the Middle East.

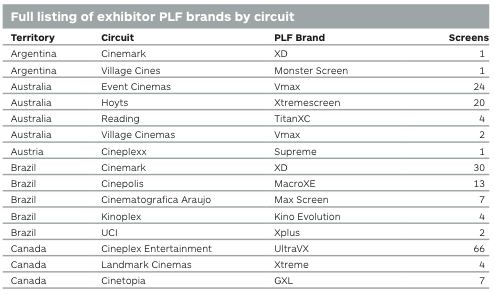

The report does a commendable job of breaking down the PLF market by region, country and exhibitor to a micro-level (see A-C country list excerpt below). We will not quote at lengths, as those who want to know should subscribe to the service or buy the report.

The report is particularly good at untangling the dynamics of the North American markets, where many exhibitors are both Imax clients and competitors with their own PLFs, sometimes even in the same venue.

Cinemark with 108 XD screens has the largest PLF footprint in the US, followed by Regal with 76 RPX screens, Carmike with 26 Big D screens and AMC with 13 ETX screens plus a further six AMC Prime auditoriums. Together, the top five exhibitors accounted for the majority or 83 per cent of total PLF screens in the US, a very large proportion over and above their average screen penetration. Marcus Theatres is the number five PLF screen operator in the US and also credited with first introducing its concept, UltraScreen, in 1999. A newer concept UltraScreen DLX was introduced in 2013 incorporating all reclining seats (DreamLoungers) with screens 65ft or wider. It currently has 11 UtraScreen DLX installed.

The report charts how large US chains were the first out with their own PLFs, but the medium-sized and smaller chains are now also following their lead.

Two Biggest Competitors

Because the report is data-driven, with numbers analysis rather than editorialising, it only hints at what the most significant competitors and potential threats to Imax are. With own-brand PLF and Imax having settled into a balance-of-power (call it ‘frenemy’) status in regions such as Europe and North America, the biggest challengers are not own-brand but are they are specific to two territories.

Interestingly these are not territories where Imax is absent, with typically small countries like Greece, Ireland, Ecuador and Lebanon being 100% non-Imax PLF cinema screen equipped. Rather they are countries where Imax has a significant presence and have identified as key to major future growth. This makes the battle all the more critical over the next few years.

The first one is Russia, which is where the report correctly points out “Formula Kino in Moscow will be one of the first Imax laser theatres in December 2015.” In addition to this Formula Kino is also where Imax is launching Saphire, “a premium large format concept combing the larger screen with a more intimate seating capacity of up to 50 seats.”

Yet even with a significant back-order in Russia, Imax faces a very real threat there in the form of RealD’s Luxe PLF umbrella brand format [PDF link], 10 of which it will install with Russia’s Karo cinema alone. Luxe is the first significant attempt to create a PLF brand not specific to any on cinema chain. Significantly it is also primarily targeted at emerging markets such as Russia, Bulgaria and Romania without a large existing installed base of either Imax or own-brand PLFs.

The second competitor and territory is China Film Giant Screen (CFGS) in China, which we have written about extensively before. While it only has 50 screens as of 1H 2014 (compared to a total of 32 for the two Chinese own-brand PLFs Poly Film’s Polymax and Wanda X Land), it should be remembered that China is not only the world’s second largest cinema market but also the second largest PLF market.

With Imax’s head of operations in China recently revealing that while it only had 1% of cinema screens in the Mainland, these represented close to 10% of total box office takings, it means that one day Imax China will overtake the BO takings from Imax’s screens in North America if they can continue the current rate of expansion. The potential threat from CFGS is thus of a different magnitude compared to that posed by own-brand PLF in China and elsewhere.

It is also important to remember that China’s film import restriction quote is often going to automatically favour CFGS.

At the moment it allows imports of 20 films in 2D or 3D and a further 14 exclusively in 3D and PLF. This means that films that are only released in 2D outside China have to be converted to 3D exclusively for China, as was the case for “RoboCop” earlier this year and more recently for Luc Besson’s “Lucy”, which knocked “Guardians of the Galaxy” off the top of the Chinese box office, not least on the strength of PLF screens. These films are converted to 3D by CFGS, which means that Imax is effectively locked out from showing them.

Equally dangerously for Imax – which up-converts films through its proprietary in-house DMR process – it was announced this week that Deluxe is partnering China Film Co. on behalf of CFGS to construct “a 115,000-cubic-foot mastering facility and screening room in Los Angeles.” This will enable services such as subtitling, up-converting and 3D conversion for CFGS screens in China to take place in Hollywood, closer to production and eliminating security risks with sending the film abroad for post-processing.

“The CGS format offers not just an enlarged image but an image that’s greatly enhanced to accommodate the large format ,” said Joe Hart, senior vice president of Deluxe Digital Cinema. “Deluxe is thrilled to provide the state-of-the-art mastering services required. We expect the new mastering facility and screening room to act as a real showcase for the format and related technology.”

The CGS format produces projected images of more than 65 feet wide and 35 feet tall.

“CGS, as a premium large-format cinema system based on proprietary technology, has won wide support both from China and the international community, including most major players from Hollywood, ” said Lin Minjie, chairman of China Film Digital Giant Screen (Beijing) Co. Ltd. “We are very excited to work together with Deluxe in providing mastering services for CGS screens and promoting CGS systems in the broader market. Our joint effort will undoubtedly bring even more successes to CGS and deployments of the system.”

The IHS report concludes by looking at how PLF fits in with premium entertainment destinations in cinemas, which encompasses interactive and gaming screens, VIP screens, Barco Escape-type 3-screen auditoriums (a format CJ CGV Screen X pioneered a year earlier – though IHS strangely lumps this together with other PLFs) and 4DX-type motion seat.

It notes that the “concept of cinema is also evolving to include multiple entertainment options” and that “[p]remium large format screens are now a core part of exhibitors’ strategy to reinvigorate the cinema experience and drive admissions towards higher priced tickets.”

Yet if you want to know where the future of Imax and PLF is being decided, don’t look to established markets like the United States and the UK, but to the all-important markets of Russia and China. I remember laughing many years ago when I came across a DVD of Imax’s successful “Everest” documentary, a film which truly even the biggest plasma television screen at the time could not do justice. These days you can sign up to pre-order an Imax home cinema installation, but only if you are a millionaire living in China.