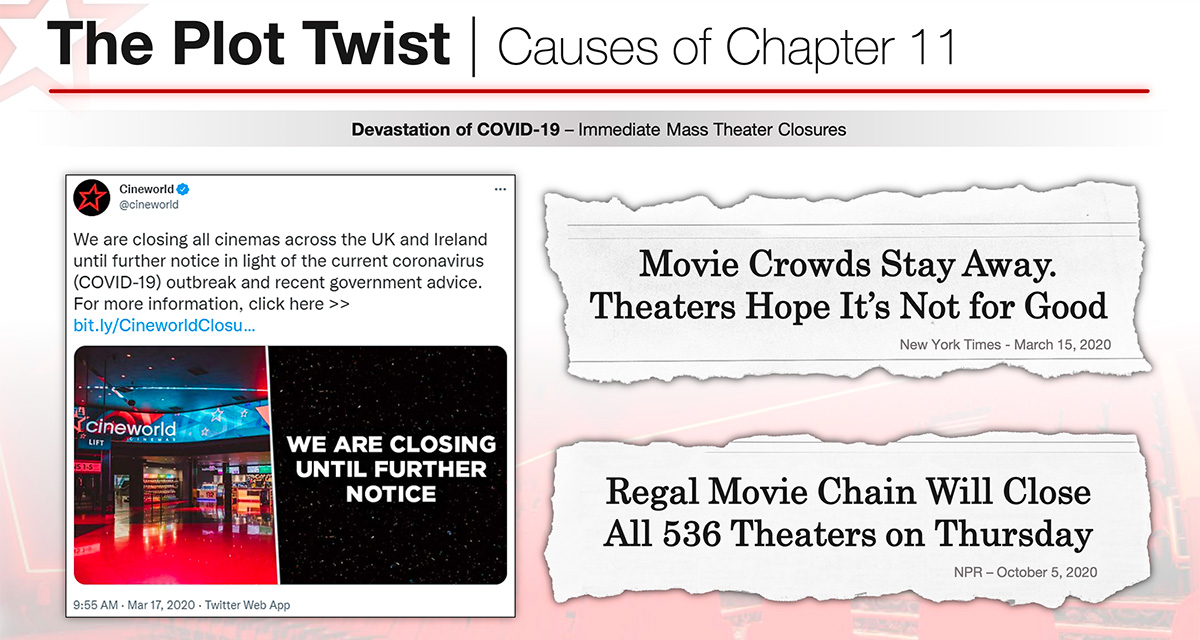

This is the second of a three part series examining some of the finer points and details of Cineworld’s ongoing bankruptcy in an attempt to provide some analysis for what it all means for the company and the industry-at-large. On 7 September the world’s second largest movie theatre operator filed for Chapter 11 in U.S. Bankruptcy Court in the Southern District of Texas. This series is not meant to disparage Cineworld but rather explain the complicated process such an exhibitor must go through to reorganize and restructure its business through bankruptcy.

The first of this three part series fills in some of the blanks about the bankruptcy process Cineworld has now embarked on and some of the subtleties that are often glossed over. The second part of the series will lay out the road ahead for Cineworld as they move through the bankruptcy process. The third part will review the effect Cineworld’s bankruptcy will have on other stakeholders in the market, not to mention what happens to Cineworld’s shareholders.

In part 1 of the series we left off with Cineworld, having gone through the early stages of its bankruptcy, sitting down with its creditors at a gathering known as a Section 341 meeting.

Cineworld’s Bankruptcy Journey

In his book “The Hero’s Journey,” mythologist Joseph Campbell defined the structure of most classic stories, fables and myths as a circular journey. Our hero sets out on a quest, is tested through various trials and tribulations, overcomes a “major ordeal” to win treasure or knowledge before returning home with the prize, a changed but wiser person. George Lucas famously used these teachings when developing Star Wars.

To maintain the cinematic narrative motif Cineworld employed in its presentation to the bankruptcy court on 8 September, the Section 341 meeting the company is required to attend could either prove to be the “major ordeal” of their bankruptcy journey – the moment of greatest conflict – or it could simply be procedural, turning into one more hurdle to overcome in their quest to reorganize. It really depends on which, if any, of Cineworld’s creditors show up.

This public hearing, which in Cineworld’s case is scheduled for 17 October, is overseen by the United States Trustee, not the court. It allows all of Cineworld’s creditors to question the company under oath about its assets, liabilities, past behavior, and administration of the bankruptcy. If enough creditors turn up at this meeting then the questions being asked could effectively be the start of negotiations with Cineworld over how the company will discharge its debt and reorganize. This is why the Chapter 11 process is often said to be a negotiation.

Realistically, it will probably take more than a single meeting for Cineworld to reach any sort of consensus among unsecured creditors. As well, because all contracts during a Chapter 11 bankruptcy can be voided or renegotiated, Cineworld will also use this period to deal with their hundreds of commercial retail locations, as they alluded to in their filing press release:

Cineworld expects to pursue a real estate optimisation strategy in the US and intends to engage in collaborative discussions with US landlords to improve US cinema lease terms in an effort to further position the Group for long-term growth.

This can be translated as Cineworld will be renegotiating a lot of their current leases or walking away from the site. The company has already closed at least 12 multiplexes in California (Fresno, Los Angeles, Orange County, San Jose), North Carolina (Greenville), Ohio (Cleveland), Oregon (Portland), Texas (Amarillo) and Washington (Seattle, Tacoma). The reason given was that these were underperforming venues, these were also likely theatres where Cineworld knew the landlord would not negotiate, so they essentially walked away from the locations and their past due rent.

Presently Cineworld is in a period in which it has the exclusive right to file a plan of reorganization (POR). Before their exclusivity period ends in 120 days, Cineworld will need to file a disclosure statement and their POR with the court. The disclosure statement is a lengthy document which goes into detail about the company, its assets, liabilities, past history, description of its debts, a summary of the reorganization plan, any of the tax consequences and much more. It is designed to provide enough information for any stakeholder (creditor, lender, etc.) to make an informed decision about the POR being proposed.

The POR is the document which outlines how Cineworld proposes to restructure its past debts and reorganize its ongoing operations into a sustainable and profitable organization over the longterm. It will include the sale of any assets, layoffs and most importantly an explanation of how each class of creditors will be paid back over time either fully or partially. In a 19 September meeting with their lenders, Cineworld said they were planning to submit their plan by 31 October, moving up their original timeline by 21 days.

Once submitted, the court will have to ensure the disclosure statement has “adequate information” and that the POR passes the “fair and equitable” test. This can get very complicated but, in brief, the judge looks at the plan and ensures all creditors are paid back in their order of priority (secured creditors first) and no more than 100% of their claim.

After Judge Marvin Isgur, who is overseeing Cineworld’s case, approves the reorganization plan and the disclosure statement, Cineworld will need to submit the plan to creditors who can then vote to accept or reject the plan. Ideally, a debtor like Cineworld has been negotiating with enough of their creditors that the details of the plan will not come as a surprise.

Another wrinkle that might help studios out is that only creditors in an impaired class get to vote on the plan. So, if Cineworld decides to pay 100% of their secured lenders’ claims, even if it takes several years, then that class of creditors would not be impaired. Unsecured creditors like concession vendors, landlords and government tax authorities will probably only see a percentage of their claims being paid and, as such, those claims will be impaired and those creditors will vote on the plan. This is where bundling studios into a critical vendor class of creditors can work in Cineworld’s favor, because if the exhibitor pays them back in full their claims won’t be impaired and they won’t get a vote.

This may be why Lionsgate Vice Chairman Michael Burns felt confident in telling an investor conference on the day Cineworld filed for bankruptcy “I do think the studios will get paid, like they usually do, whatever they are owed. Because we are the suppliers and that’s usually what happens.”

Cineworld will have an additional 60 days, or 180 days from their original filing date to modify their reorganization plan to appease creditors and gain their buy in, or alternatively, their vote to reject it. Any creditor that will not be paid anything at all is considered an automatic rejection vote. For the plan to pass, at least half the creditors and two-thirds of the outstanding claims in dollar amount of any impaired class must vote to accept the plan. If that occurs, then even the creditors within a class that voted to reject Cineworld’s plan could be forced by the judge to accept it in what is known as a “cramdown”.

Remember, Cineworld has thousands of vendors all of whom could potentially have impaired claims. However, clearing the two-thirds threshold could be tricky for the company if one big creditor representing a large chunk of the outstanding claims rejects the POR. This is where the USD $955 million judgement against Cineworld that a Canadian court awarded Cineplex in 2021 over a failed acquisition may present a huge hurdle.

Cineplex Cast in Role of Shapeshifter

One of the many character archetypes described by Campbell in his hero’s journey is that of “shapeshifter.” This character is both an ally and potential enemy to the hero of a story, often starting in one role and transforming into the other. In the case of Cineworld’s bankruptcy journey Cineplex is definitely a shapeshifter; starting out as an enemy (or creditor) which Cineworld hopes to turn into an ally.

Cineworld tried to acquire Cineplex, Canada’s largest movie theatre chain, starting in 2019. When the deal fell apart in 2020 amid COVID-19 closures, Cineplex filed a lawsuit against Cineworld. In December of 2021 the Ontario Superior Court of Justice ruled in Cineplex’s favor awarding CAD $1.24 billion (USD $955 million) in damages.

Cineworld appealed the decision (as did Cineplex) and oral arguments were originally scheduled for 12 and 13 October before the Court of Appeal for Ontario. However, the automatic stay in Cineworld’s Chapter 11 filing prevents such legal activity from occurring. So forty-eight hours after Cineworld entered Chapter 11 protection, Cineplex filed a motion with Judge Isgur to modify the automatic stay to exclude them. Naturally, Cineworld filed an objection to the motion on 22 September. The motion was rejected by the US bankruptcy court because, depending on the POR, unsecured creditors may not be paid back at all or receive such a low percentage of their claim (e.g. 1%), such court proceedings will be moot. However, Judge Isgur allowed the Cineplex claim to stand at 100% of its value, which is important for at least two reasons.

First, as one of Cineworld’s biggest creditors, Cineplex was placed on the Official Committee of Unsecured Creditors (UCC), by the US Trustee. The UCC is meant to negotiate with the debtor on behalf of all unsecured creditors. Second, the whopping USD $955 million claim could represent such a high percentage of the full dollar amount of all impaired claims that Cineworld won’t be able to reach the two-thirds threshold without Cineplex buy-in. (This is likely why there have been media reports that Cineplex is in discussions to take over Regal, Cineworld’s US-based theatre chain.)

If Cineworld fails to gain acceptance of its plan from impaired creditors within the 180 day time frame, the creditors themselves could then submit their own reorganization plan for the company. This includes the option of liquidating the company to pay off creditors. In the case of Cineworld that option is less likely since the company is worth more as an ongoing operation than it would be if sold off in parts.

Exit Through The Cramdown

Once the votes on the POR are in, and if it is approved by the creditors, the court will determine if it meets the requirements of a Chapter 11 bankruptcy filing, including whether:

- Cineworld will be able to meet the obligations defined in the plan.

- Cineworld is proposing the plan in good faith.

- Cineworld will pay its creditors at least as much as they would have under a Chapter 7 liquidation bankruptcy.

- Cineworld is treating all of its creditors fairly and equitably and not paying creditors more than the amount of their associated claim.

This will take place during a confirmation hearing, which may be broken up into multiple steps if Cineworld needs to request a cramdown of non-accepting classes. Barring any objections being filed, the court will approve the reorganization plan and Judge Isgur will issue an order of confirmation. This order will contain a schedule for the timing and amount of all payments Cineworld will have to make to comply with the plan.

Fourteen days after the confirmation order is issued Cineworld becomes bound by the plan of reorganization and all of the debts accrued before the date of confirmation are discharged. The POR will become the standing contract between Cineworld and its creditors. This is why the POR is such an important part of any Chapter 11 bankruptcy case. If Cineworld fails to make a payment or violates the terms of the POR, the court could dismiss its bankruptcy or even force a liquidation of the company.

While Cineworld hopes to get through this entire bankruptcy legal process in a six-month time span, the company will be living with the reorganization plan and paying claims for anywhere from three to five years. During that time all of the company’s “disposable income” will go toward paying back creditors under the plan.

In Part 3 we will look at what bankruptcy means for Cineworld shareholders, as well as a few potential outcomes for the company as they move through bankruptcy. Part 1 of the series goes into detail about the beginning stages of Cineworld’s bankruptcy.

- As Sundance Says Goodbye to Park City, Its Films Look Forward - January 21, 2026

- Opening Night at the 2025 Red Sea Film Festival Showcases Saudi Arabia’s Growing Cinematic Ambition - December 5, 2025

- Arts Alliance Media Enters Administration — But Don’t Write Its Obituary Yet - November 21, 2025