When Luis Vargas took the stage at CineLATAM 2025 in Miami this past September, he didn’t begin with a data slide. Instead, the Vice President for Latin America at Comscore Movies opened with a story — or rather, with a movie title: “Ainda Estou Aqui,” (“I’m Still Here.”)

The Oscar winning Brazilian drama has become both a box office triumph and a fitting metaphor for the region’s cinema industry. “They told us that cinema would disappear,” Vargas told the audience of exhibitors, distributors, and producers. “They said no one would go to the movies anymore. But here we are. ‘Ainda estou aqui.’”

That refrain carried through not just his CineLATAM address but also his appearance two weeks later on the CJ Cinema Summit, where he joined Thomas MacCalla and myself to discuss updated data and insights on the Latin American theatrical market. Across both presentations, Vargas painted a picture of an industry that has not only recovered faster than most of the world but continues to grow in ways that defy old assumptions.

He noted that “for decades, the prophets of apocalypse have been telling us that cinema will end. Other platforms may come and go, but cinema remains. Cinema will live as long as boyfriends and girlfriends live — as long as people still want to sit together in the dark to feel something.”

A Region That’s Outpacing the World

According to Comscore’s latest figures, Ibero-America has recorded the strongest theatrical recovery of any global region. By the end of 2024, cinema attendance across the region had reached 73% of its pre-pandemic average (2017–2019), outpacing North America (61%), Asia-Pacific (63%), and Europe / Middle East (72%).

Even more impressive, Ibero-America posted the second-highest two-year growth rate (+5%) behind only Asia-Pacific’s 16%. Vargas pointed out that if China and India were removed from Asia-Pacific’s calculation — both markets large enough to skew the numbers — Ibero-America would effectively lead the world in growth.

“We’ve increased our global market share from 10.7% before the pandemic to 12% in 2024,” he said. “That’s a big jump when you consider that these are figures in US dollars, which means exchange rate fluctuations could easily work against us. Yet we’re still growing.”

While the early 2025 numbers show a 6% decline in grosses compared to 2024 (USD $359 million versus USD $382 million through August), Vargas was quick to put that dip in context, noting that “the first half of the year is always uneven. Post-COVID, the second semester has become far more important to the business than the first.”

Doing More With Less

One of the region’s greatest strengths, Vargas emphasized, is its efficiency. Latin America represents 19.5% of total box office in the Americas, 41.8% of admissions, but only 29% of the continent’s screens. In other words, Latin American exhibitors are achieving far more with fewer resources.

The region’s footprint has continued to expand even as other parts of the world consolidate. Compared to 2019, the number of cinema locations is up 6%, and total screen count has grown 2%, reaching roughly 16,000 screens across nearly 3,000 sites.

“If cinema weren’t a viable business, no one would be investing in it,” Vargas said during the CJ Cinema Summit. “But there’s a non-stop wave of investment. It’s not cheap to build a cinema, especially now that premium experiences are the norm. Yet developers and exhibitors keep doing it — because people still love going to the movies.”

Country by Country: Resilient Audiences

The region’s top markets are largely holding steady, with some intriguing movement beneath the surface.

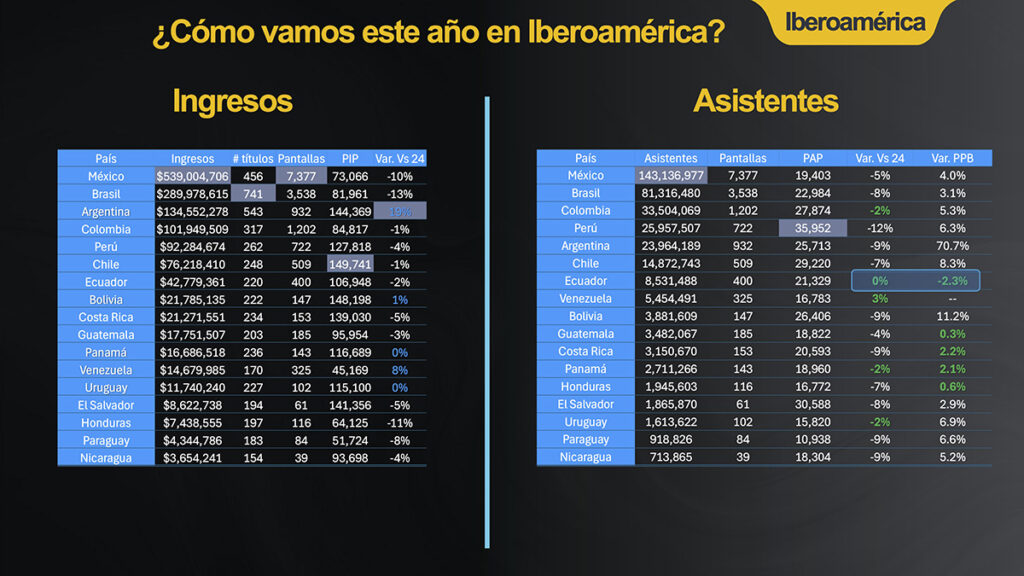

Mexico remains the powerhouse, generating USD $539 million in grosses and 143 million admissions across 7,377 screens — roughly one-third of the region’s total attendance. Brazil follows with USD $290 million and 81 million tickets sold, even as its per-screen averages dipped slightly. Peru continues to punch above its weight, with an average of nearly 36,000 admissions per screen, the highest in Ibero-America every year since 2017. Ecuador and Venezuela were the only two countries to show real growth in admissions compared to 2024, with Venezuela up 3% despite ongoing economic challenges.

“Ecuador managed something remarkable,” Vargas said. “It’s not only one of the few markets growing in admissions, it also reduced its average ticket price. That combination is rare — and it shows how smart pricing and programming strategies can stimulate attendance.”

Local Content on the Rise

While Hollywood continues to dominate regional screens — US titles accounted for nearly 45% of all admissions between 2020 and 2025 — Latin American productions are beginning to reclaim audience share. Local films made up 5.5% of total admissions in 2025, up from 5.1% the year before.

At the top of the list sits “Ainda Estou Aqui,” distributed regionally by Sony’s Colombia Pictures. The film grossed over USD $41 million worldwide, selling more than six million tickets across 33 countries. It’s now the fourth highest-grossing Brazilian film in history and the seventh by attendance.

Other local titles also made their mark. The Mexican hit “Mesa de Regalos” (distributed by Disney) captured 10% of the domestic admissions market, while Argentina’s “Homo Argentum” and a wave of smaller Spanish-language dramas helped push regional releases past 250 titles for the year, a 20% increase over 2024.

Premium Formats and the Power of Experience

The audience may be changing, but Vargas believes the secret to Latin America’s strength lies in its commitment to premium experiences. He often repeated the line, “Content is king, but experience is queen.” That philosophy is evident in the rapid growth of VIP auditoriums — a format invented in Mexico in 1998 by Cinépolis. As of August 2025, there were more than 1,000 VIP screens across the region, accounting for over 5% of total box office revenue, up from just 2.6% a decade earlier.

3D has also remained a consistent draw in the region. Across Ibero-America, 6.3% of admissions this year came from 3D titles, with Paraguay (27%), Uruguay (18%), and Argentina (16%) leading the pack. Vargas considers 3D “a premium format that behaves like one,” noting that “it depends entirely on content — people aren’t naïve. They’ll pay extra for the right movie, the right experience, not just the technology. When we release a film like “Avatar” or “Inside Out 2” in 3D, you can feel the difference in the numbers.”

The Alternative Content Boom

Another major shift since the pandemic has been the rise of alternative content (also known as event cinema) — everything from concert films to esports events. Once a negligible niche, this category has surged to 1.4% of total grosses and 1.08% of admissions in 2025, up from 0.26% in 2019.

Vargas credits the trend to younger audiences and creative programming by exhibitors. “Eighty-five percent of alt-content admissions are from people under 25,” he explained. “That’s who we need in our theatres — young people. Taylor Swift’s concert movie was a perfect example. The pre-sales were unbelievable.”

Between 2018 and 2024, total box office from alternative content in Ibero-America quadrupled, rising from just USD $10 million to nearly USD $40 million, before easing slightly this year as the market normalized.

Big Movies Are Bigger In Latin America

Vargas often emphasizes that cinema is not a medium but an experience. That philosophy is reflected in how major titles perform in the region. Four of the ten highest-grossing films in Ibero-America’s history were released after 2020, and five of the ten most-watched films came out post-pandemic. The single highest-grossing and most-attended title in the region’s history — Pixar’s “Inside Out 2” — was released just last year.

“If we weren’t in good shape, how could that happen?” Vargas asked. “Half of our biggest movies ever came out in the past five years. That tells you something.”

Even in 2025, with a somewhat softer release calendar, blockbusters like “Mission: Impossible 8” and “Superman” performed strongly across key territories, though regional preferences sometimes diverged from those in North America. Whereas “Inside Out 2” represented 11% of the US box office in its release window, it accounted for an extraordinary 20% share in Ibero-America.

The Story Behind the Numbers

Numbers only tell part of the story, and Vargas is the first to admit it. Beneath the charts, he sees an emotional truth about why people keep returning to theatres — a truth that may explain why the region is outpacing much of the world.

He often reminds audiences that the cinema industry is not in the business of selling widgets or toasters. “We’re in the most human art form of all — storytelling,” he said in Miami. “To understand our industry, you have to understand that we’re in the business of connection. That’s why, even after everything, people keep coming back.”

That connection, he added, extends across borders. In many ways, Ibero-America’s success lies in its shared identity — a region bound by language, culture, and a deep belief in the theatrical experience. “Ibero-America is the most vibrant region in the world,” Vargas said. “It’s not just Latin America; it’s Spain, Portugal, and all of us who share a love for cinema and language. We’re telling our stories, and we’re not going anywhere.”

A Market Built on Persistence

If there’s a through-line connecting all of Vargas’s observations — from the growth of premium formats to the rebound of local productions — it’s persistence.

“Persistence is the productive sister of resilience,” he told the CineLATAM audience. “Resilience is enduring; persistence is enduring with purpose. Cinema is persistence and as long as we keep telling stories, we’ll keep finding audiences.”

Indeed, for exhibitors, distributors, and filmmakers across the region, it’s a reminder that despite economic headwinds, streaming competition, and changing audience habits, Latin America’s cinemas have proven remarkably durable.

As Vargas put it, “People said the cinemas would close, but we’re still opening new ones. They said streaming would kill us, but we have more releases than we did in 2019. They said the audience was gone, but we’re selling hundreds of millions of tickets every year. The numbers speak for themselves — and they say: Ainda estou aqui! I’m still here.”

- As Sundance Says Goodbye to Park City, Its Films Look Forward - January 21, 2026

- Opening Night at the 2025 Red Sea Film Festival Showcases Saudi Arabia’s Growing Cinematic Ambition - December 5, 2025

- Arts Alliance Media Enters Administration — But Don’t Write Its Obituary Yet - November 21, 2025