In 2024, one in three US studio movies grossing over $100m were family titles

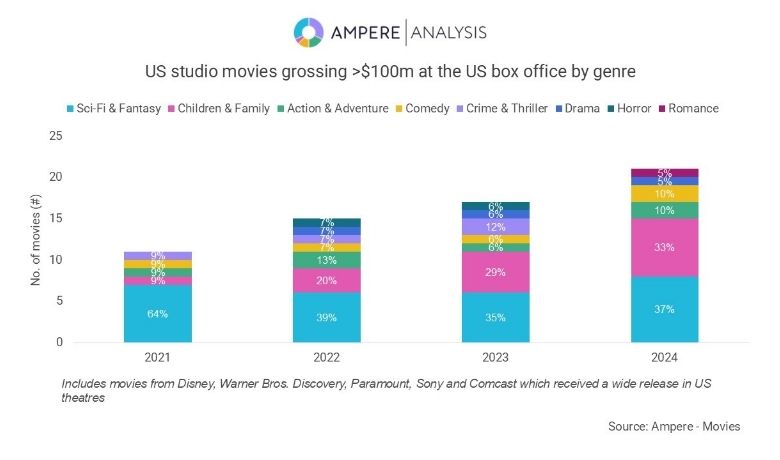

Family films are playing an increasingly vital role in Hollywood’s box office success, according to a new report from Ampere Analysis. In 2024, one-third (33%) of US studio films that grossed over $100 million were family-oriented titles—up from just 20% in 2022. With their significant spend on streaming, pay TV, cinema visits, and other entertainment services, families are a disproportionately valuable segment of the media market. Yet as streamers cut back on commissioning original family content, they’re increasingly reliant on evergreen shows and recent theatrical releases to serve this key demographic. A regular flow of new family films now delivers not just box office returns, but vital licensing opportunities—helping platforms retain and engage this crucial audience segment.

Alice Thorpe, Research Manager at Ampere Analysis, says: “Catering to families has always been a key factor in studio decision-making, but recent years have reinforced just how critical this audience is to the theatrical market.”

Key findings:

Richard Broughton, Executive Director at Ampere Analysis, says: “Sustained investment in family-friendly movies is not just a strategy for near-term box office success in a challenging theatrical market, but also a long-term play to rebuild the cinema-going habit among younger audiences. As these young moviegoers mature, their continued engagement with theatrical releases could shape future patterns of media consumption. For studios, this underscores the importance of treating the development and distribution of kids’ movies not only as a commercial imperative, but as a key part of a long-range audience strategy.”

About Ampere Analysis

Founded in January 2015, Ampere Analysis is a new breed of media analyst firm. The company’s experienced team of sector-leading industry analysts specialises in sport, games, pay and multiscreen TV and next generation content distribution. Our founders have more than 60 years’ combined experience of providing data, forecasts and consulting to the major film studios, telecoms and pay TV operators, technology companies, TV channel groups and investment banks. www.ampereanalysis.com