Arts Alliance Media (AAM), one of the cinema industry’s most widely deployed and quietly indispensable software providers, entered administration in the United Kingdom on 12 November 2025. This move begins a restructuring process, similar to Chapter 11 bankruptcy in the United States, that could reshape the global theatre management system (TMS) landscape. The company is continuing to operate while administrators seek a buyer — a situation that has generated both understandable concern and a surprising amount of optimism across the industry.

BDO LLP has been appointed to oversee the process, with joint administrators Simon Girling and Danny Dartnaill confirming that AAM was placed into administration due to “funding challenges experienced following the COVID pandemic and the US screenwriters’ strike.” Importantly, they stressed that the company remains fully operational.

“Our strategy is to continue to trade while we seek a buyer for the business as a going concern,” Girling said in a statement provided to Celluloid Junkie.

For a company whose software powers tens of thousands of cinema screens, the stakes extend far beyond a single balance sheet. This isn’t just an IT vendor hitting turbulence. It’s a critical pillar of digital cinema infrastructure entering a transition point — one that nearly every exhibitor has a vested interest in seeing resolved smoothly.

A Quiet Workhorse Behind 42,000 Global Screens

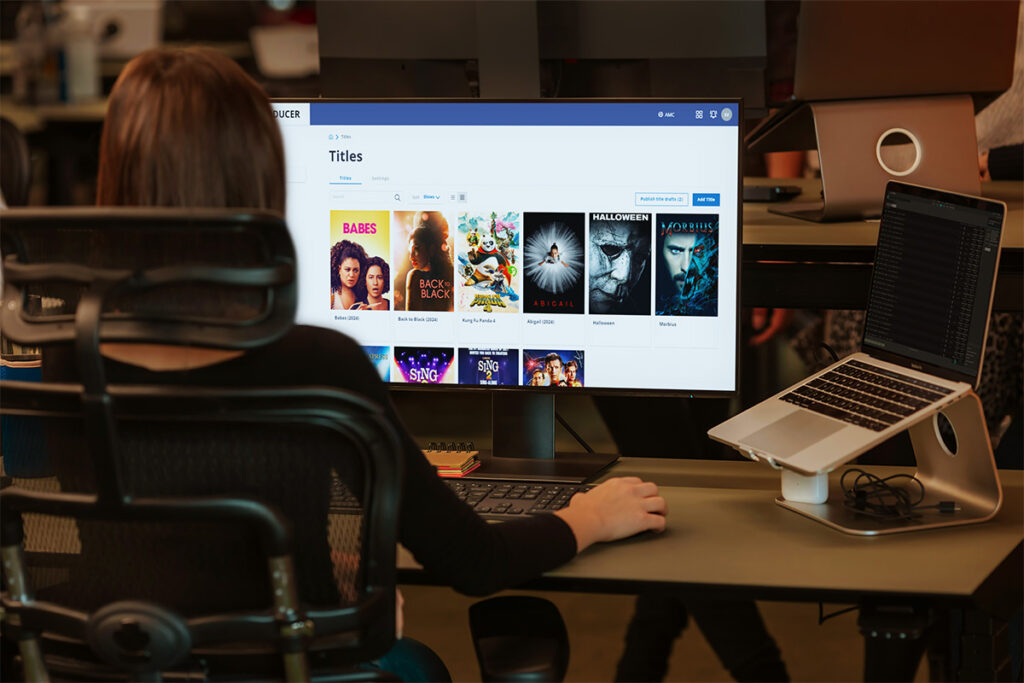

If you’ve ever been inside a cinema projection booth — or, these days, the half-closet that passes for one — chances are good you’ve seen AAM’s software running. Screenwriter, Lifeguard, AdFuser, Producer… the names don’t appear on marquees, but without them, most of the cinemas using them would struggle to get movies on screen reliably, on time, and with the right content.

AAM’s software reaches more than 42,000 screens across North America, Europe, Asia, Latin America and Australia. Its client list includes AMC, Regal, Hoyts and dozens of regional and independent circuits. Many film festivals — including TIFF, Sundance, Rome, San Sebastián among others — rely on AAM systems to run complex, multi-venue operations that make weekday multiplex scheduling look easy.

Along with Unique X, AAM is one of two leading TMS providers operating at this global scale. When a company that underpins such a level of day-to-day exhibition activity enters administration, the impact reverberates far beyond its London headquarters.

What Exhibitors Are Saying: Concern, Yes — But Not Panic

One of the more interesting things about the last week has been the industry’s reaction. Exhibitors aren’t panicking — this isn’t one of those moments where servers have gone dark and Saturday night shows hang in the balance. Exhibitors contacted by CJ consistently expressed confidence that AAM’s services and support will remain stable during the administration period, but stressed the importance of clear and timely communication and a swift conclusion to the sale process, especially heading into a busy winter release window.

Their concerns are more strategic than immediate. Put bluntly: the industry needs two strong competitors and they don’t want the market to shrink to a single TMS provider. Monopolies in exhibition tech tend to age about as well as milk left under a xenon lamp.

How a Market Leader Found Itself in Administration

AAM’s current situation is not the result of product decline, customer attrition, or evaporating demand. If anything, the company’s global footprint and product suite remain exceptionally strong. Instead, a series of structural, financial, and industry-wide pressures converged over several years.

Since 2017 AAM has been owned by Luxin-Rio, a Chinese entertainment and cinema technology group. Over the past three years, Luxin-Rio has faced significant difficulties across several of its cinema-centric subsidiaries. Volfoni, its 3D technology firm was shuttered and MediaMation, its motion seat and atmospheric effects company, was sold back to its founders.

People familiar with AAM’s structure say the UK business was the strongest performer in the group, often requiring it to support some of Luxin-Rio’s other entities. AAM’s published accounts show large intercompany balances and cash movements tied to affiliated companies in China. And as the group’s other ventures struggled, the pressure on AAM intensified.

And alongside these internal movements, as most industry watchers well know, the cinema business spent most of 2023 and early 2024 regaining its footing after the pandemic, only to be immediately hit with the double blow of the writers’ and actors’ strikes. Fewer movies meant fewer admissions, which translated into budget freezes across theatrical exhibition. That slowdown trickled down to technology vendors, including AAM, as cinemas delayed upgrades and postponed larger software projects.

Costs Rose as AAM Accelerated Development

AAM continued to invest aggressively in modernising its software — developing Producer 2.0, expanding API capabilities, adding energy-saving features to Screenwriter and Lifeguard, and pushing forward on its cloud roadmap.

If there’s a criticism to be made, it’s not that AAM stood still, it’s that the company kept building even as the rest of the industry was duct-taping budgets together and hoping next summer’s tentpoles didn’t migrate to 2026.

Administrative expenses more than doubled from GBP £2.3 million in 2022 to GBP £5.4 million in 2023, the last year for which AAM financials are available. Combined with group-level obligations, that increase pushed the company into a loss – the numbers tell a story of a company that was profitable before group obligations began exerting too much weight:

- A GBP £1.04 million profit in 2022

- A GBP £2.82 million loss in 2023

Operationally, AAM remained strong. Cash flow, however, became increasingly strained.

Based on conversations with individuals close to the company’s forecasting process, AAM expected to return to profitability in the coming 12 months once freed from group obligations and after exiting a long-term, high-cost office lease in London. Internal projections indicated potential profitability of roughly GBP £1 million (USD $1.31 million) under its current subscription revenue model.

A Leaner AAM, Still Trading, and Preparing for New Ownership

In the months leading up to administration, AAM took steps to streamline its cost base, including reducing headcount and exiting an office space that had long outlived its necessity. And despite the restructuring, clients report that AAM’s systems continue to operate normally. Updates are being released. The Network Operations Centre remains active. Support workflows are functioning. The company is smaller, yes — but still fundamentally intact.

Administration also effectively decouples AAM from Luxin-Rio, which many in the industry quietly describe as a turning point that was likely inevitable.

Who Might Buy AAM? The Industry’s Shortlist Forms

If you’ve been around exhibition long enough, you can probably guess the usual suspects. In this industry, when a company of AAM’s scale enters play, the same handful of names inevitably pop up like characters in a long-running sitcom: the software giant, the hardware manufacturers, the direct competitor everyone has an opinion about, and the private equity fund quietly sharpening its spreadsheets.

Software and Service Companies

Cinema software providers are natural candidates and sure enough, Vista Group is the name that appears most frequently in industry conversation. Historically acquisitive, Vista has consolidated many of its prior purchases under a unified brand. AAM’s product set could theoretically fit within that architecture, though Vista’s recent M&A strategy has been more selective.

The same could be said for CinemaNext, Moving iMage Technologies, Strong Technical Services or any number of cinema integrators with a broad service footprint. Adding AAM’s software suite would make their offering much more compelling in a competitive market.

Hardware Manufacturers

Major cinema technology manufacturers, those with a global install base and strong exhibitor relationships, could see AAM as strategically valuable. Four names appear consistently in industry speculation: projector giants Barco and Christie, as well as equipment manufacturer GDC and cinema tech stalwart Dolby.

Any of these companies could integrate TMS software into broader hardware-plus-software ecosystems, though each would need to consider the operational complexity such a pairing would involve. Based on our conversations with senior figures in the market neither GDC nor Dolby currently appear to be participating in the process.

Direct Competitors

Unique X, the only other TMS provider operating at a global scale, is an obvious candidate.

However, exhibitors have been clear: they prefer not to see the market consolidate to a single provider. The administrator, however, is obligated to select whichever bid returns the best value to creditors — not necessarily the bid that preserves competitive tension in the market.

Don’t be surprised if there are whispers about Unique X being involved in the acquisition talks since, at the very least, they’ll be able to get a peek inside their competitor’s business through the due diligence process. As well, Unique X lined up USD $80 million of financing investment in 2024 specifically to help it expand globally.

Private Equity and Outside Technology Firms

Given AAM’s recurring revenue and 42,000-screen footprint, private equity interest is possible, as is interest from enterprise software companies outside the cinema sector entirely.

A Pivotal Moment — But Likely Not the Final Chapter for AAM

AAM’s future ownership remains uncertain, but its relevance is not, and that’s what matters most in the near-term. The company’s platform is too deeply embedded, too widely deployed, and too operationally essential to vanish.

If the administrator’s process moves quickly — and early signals suggest it will — AAM could emerge under new ownership before the end of the year or early in 2026. Many in the industry quietly believe the company may even be stronger afterward: leaner, independent, and finally free to reinvest in itself.

In the long sweep of digital cinema, AAM has reinvented itself several times; from VPF integrator and event cinema distributor, to TMS pioneer, to cloud automation innovator. Administration marks another transition point, but not the end of the story.

- As Sundance Says Goodbye to Park City, Its Films Look Forward - January 21, 2026

- Opening Night at the 2025 Red Sea Film Festival Showcases Saudi Arabia’s Growing Cinematic Ambition - December 5, 2025

- Arts Alliance Media Enters Administration — But Don’t Write Its Obituary Yet - November 21, 2025